Financial Obligation Investing in Property: A Overview for New York Investors

Financial obligation investing in realty is a effective method to create easy revenue while minimizing several of the threats associated with direct property ownership. In New York, where the property market is diverse and competitive, financial obligation investing supplies a calculated option for those seeking to maximize property possibilities without coming to be property owners. This guide explores the fundamentals of financial debt investing in property, the advantages, threats, and vital approaches for success in New York.

What is Financial Debt Buying Property?

Financial obligation investing in real estate involves offering cash to property owners or developers for fixed returns. Instead of owning a building, capitalists function as lenders, gaining rate of interest on the finance while protecting their financial investment with the home as collateral. These lendings are typically structured as mortgages or real estate-backed notes.

Why Take Into Consideration Financial Obligation Investing in New York Realty?

New York uses a rewarding market for real estate capitalists because of its high property worths, demand for advancement, and thriving rental market. Financial debt investing permits capitalists to take part in this vibrant atmosphere while enjoying fairly foreseeable returns.

Benefits of Financial Debt Investing:

Steady Earnings: Investors get normal interest repayments, making it a reliable earnings resource.

Lower Risk: Considering that lendings are secured by realty, capitalists have a safety net in case of debtor default.

Diverse Opportunities: From household mortgages to industrial property funding, debt financiers can pick from numerous investment vehicles.

No Building Monitoring Hassles: Unlike direct residential or commercial property possession, financial debt capitalists do not need to handle renters, upkeep, or functional concerns.

Sorts Of Property Debt Investments

Private Financing: Financiers provide directly to realty designers or fins, frequently at greater rate of interest.

Mortgage-Backed Securities (MBS): Investments in swimming pools of realty finances, giving direct exposure to numerous homes.

Realty Financial Obligation Funds: Managed funds that pool capital from multiple investors to give loans for real estate tasks.

Crowdfunded Real Estate Debt: Systems like Fundrise or PeerStreet provide possibilities to invest in fractional real estate loans.

Tough Cash Financings: Temporary, high-interest finances normally utilized by real estate programmers requiring quick financing.

Threats and Exactly How to Reduce Them

Although debt investing supplies reduced risk than equity investments, it is not without its obstacles. https://greenspringscapitalgroup.com Right here are common threats and methods to manage them:

Debtor Default: Select borrowers with solid creditworthiness and require significant collateral.

Market Variations: Focus on well-located residential or commercial properties in secure markets to make sure consistent need.

Rate Of Interest Changes: Secure favorable rates of interest or diversify financial investments across numerous fundings to stabilize changes.

Governing Compliance: Keep updated on New york city property and lending legislations to avoid lawful complications.

Exactly How to Get Going with Debt Buying New York

Research the marketplace: Understand present property trends, rate of interest, and loan demand in various areas of New York.

Select the Right Financial Investment Car: Make a decision between exclusive financing, funds, or crowdfunding based upon your threat tolerance and monetary objectives.

Analyze Borrowers Very carefully: Execute due https://greenspringscapitalgroup.com diligence on customers' credit report, experience, and project viability.

Diversify Your Portfolio: Spread financial investments across different sorts of real estate finances to decrease risks.

Get In Touch With Professionals: Collaborate with monetary consultants, realty lawyers, and home mortgage brokers to navigate the complexities of financial obligation investing.

Final Ideas

Financial obligation investing in New York realty uses an eye-catching option for investors looking for steady https://greenspringscapitalgroup.com returns without direct home ownership. By understanding the basics, assessing dangers, and executing smart financial investment techniques, you can optimize your earning capacity while minimizing exposure. Whether you're a skilled investor or simply starting, financial obligation investing can be a valuable enhancement to your property portfolio.

Are you all set to discover debt investing in New york city realty? Beginning investigating your choices today and develop a robust easy revenue stream!

Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Tina Louise Then & Now!

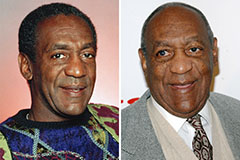

Tina Louise Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!